The PSD2 - acronym for Payment Service Directive 2 - is a European statute that came into force on 14 September last year and has become famous for the high impact it has had on anyone with home banking. Even non-experts had to deal with new policies, new platforms, multi-factor authentication systems and the gradual farewell (without many regrets) of the physical token.

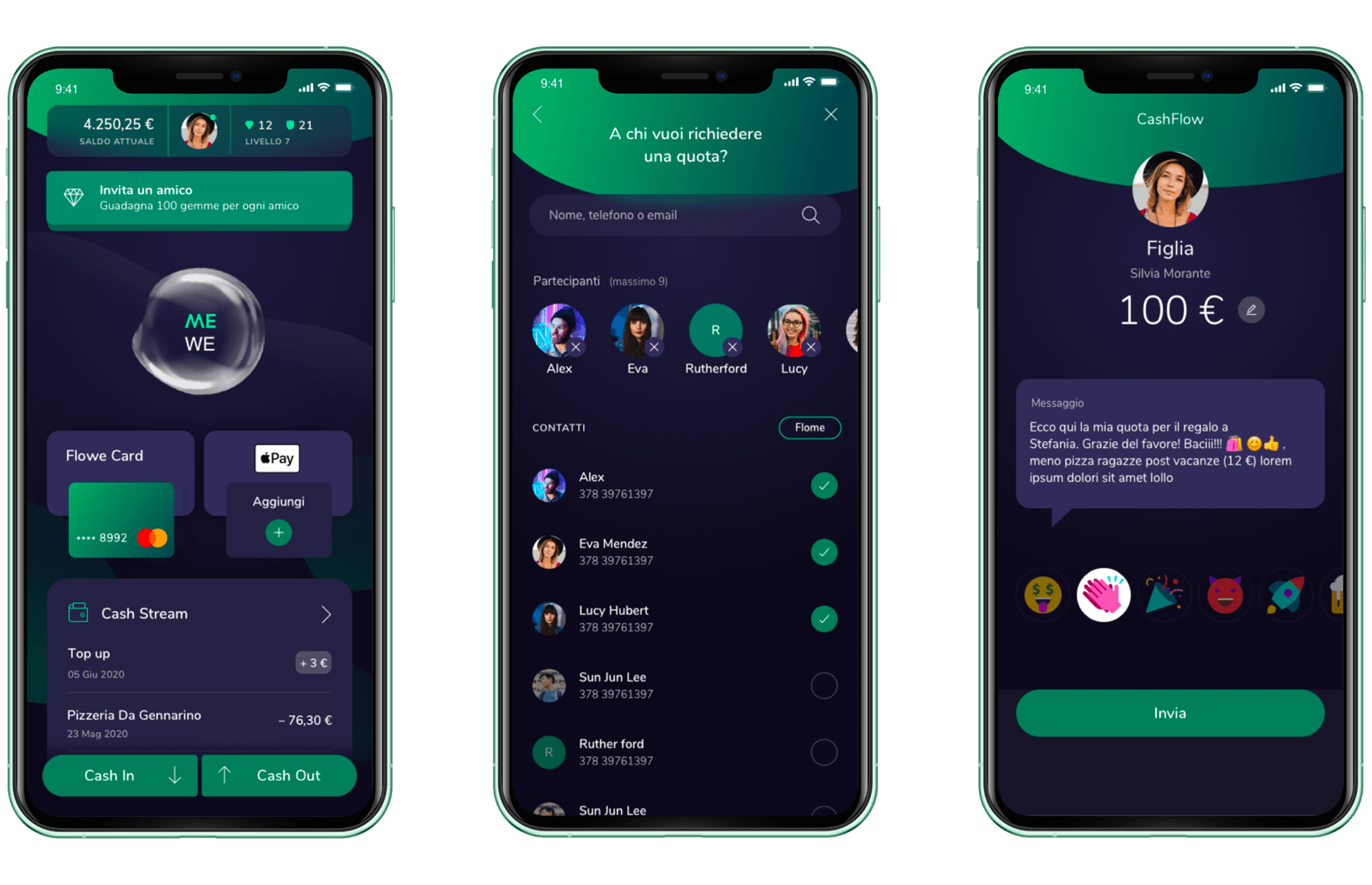

In reality, compliance is much more complicated. This law is part of the actions of the European Union to increase integration among member states (perhaps one of the steps of the complicated process of creating actual European citizenship). The PSD2 promotes an even more integrated digital payment system, supporting technological innovation and increasing the level of security of transactions. The main aims of the standard are, on the one hand, a push for digitization and innovation and, on the other, an increase in competitive dynamism in a very sedimented industry.

Among the main objectives of the PSD2 is to increase transparency for both industry operators and users by standardizing the rights and obligations of individual payment services. Moreover, precisely with a view to integration between the Member States, it is intended to increase competition between operators and between national markets, ensuring a level playing field and expanding the range of opportunities for end-users.

In the run-up to the deadline of 14 September 2019 - the date on which the legislation came into force - financial institutions have taken significant steps to open up to third parties, including competitors, adapting to the standards that will lead to the creation of a European digital single market.

Security was the fundamental prerequisite for the regulation to be applied with all its advantages, forcing the entire banking system to be renewed, and proving to be a valuable opportunity to eradicate the limits of UX all too evident of the oldest Home Banking platforms.