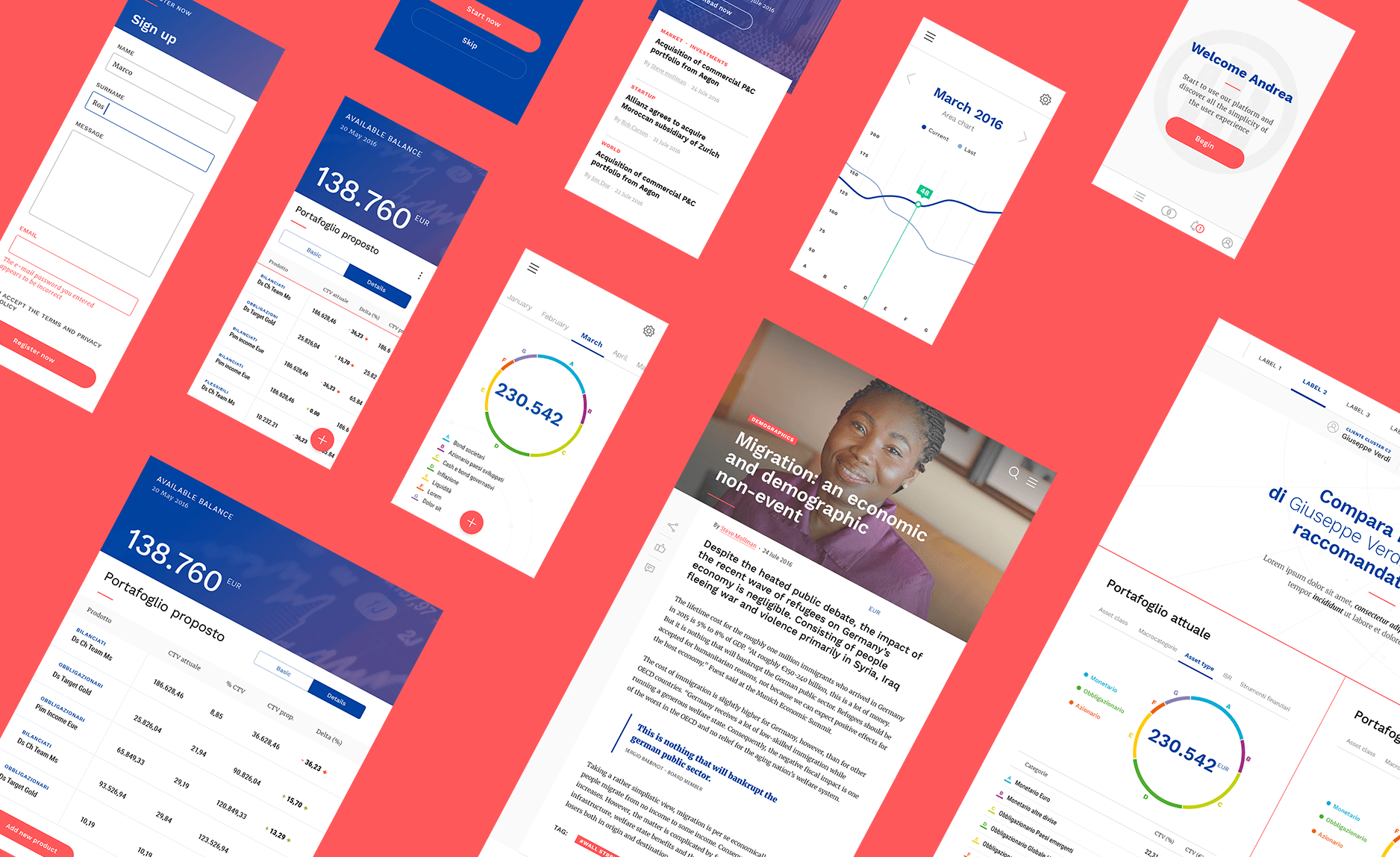

Envisioning a future-friendly service model

A variety of digital tools have always been available to Financial Advisors (FAs), yet they often remained unused. Thanks to an extensive research phase, we identified the different typologies of FAs based on their technological inclination and clients portfolio, and we mapped their journey by understanding which tools were used in specific moments of their relationship with the client.

The main insight was that there was no use of digital tools at all during the advisory moment, since all FAs prefer to have a personal and direct interaction with the client. Thus, two distinct phases emerged before and after the client’s signing: the preparation of the proposal and the following digitalization of all the information collected on paper.

With an envisioning activity, we decided to focus on the FAs’ creation of the investment proposal, trying to understand which kind of digital ecosystem could support and empower them in setting the best possible solution for the client.