2025, towards a new banking model

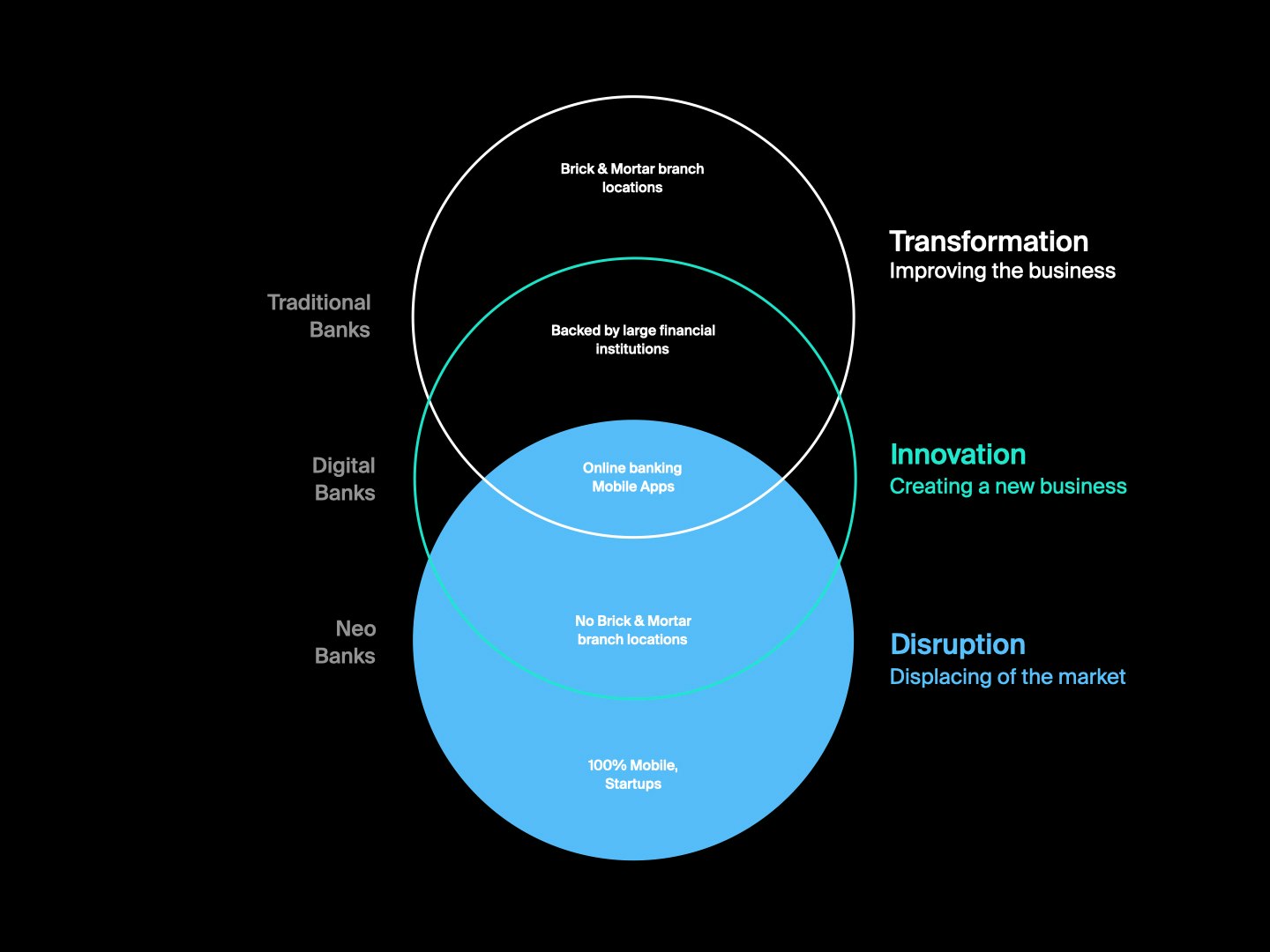

People's connection with their resources and with the entities that manage them has changed in the last five years, disrupting the model of the relationship between customers and banks.

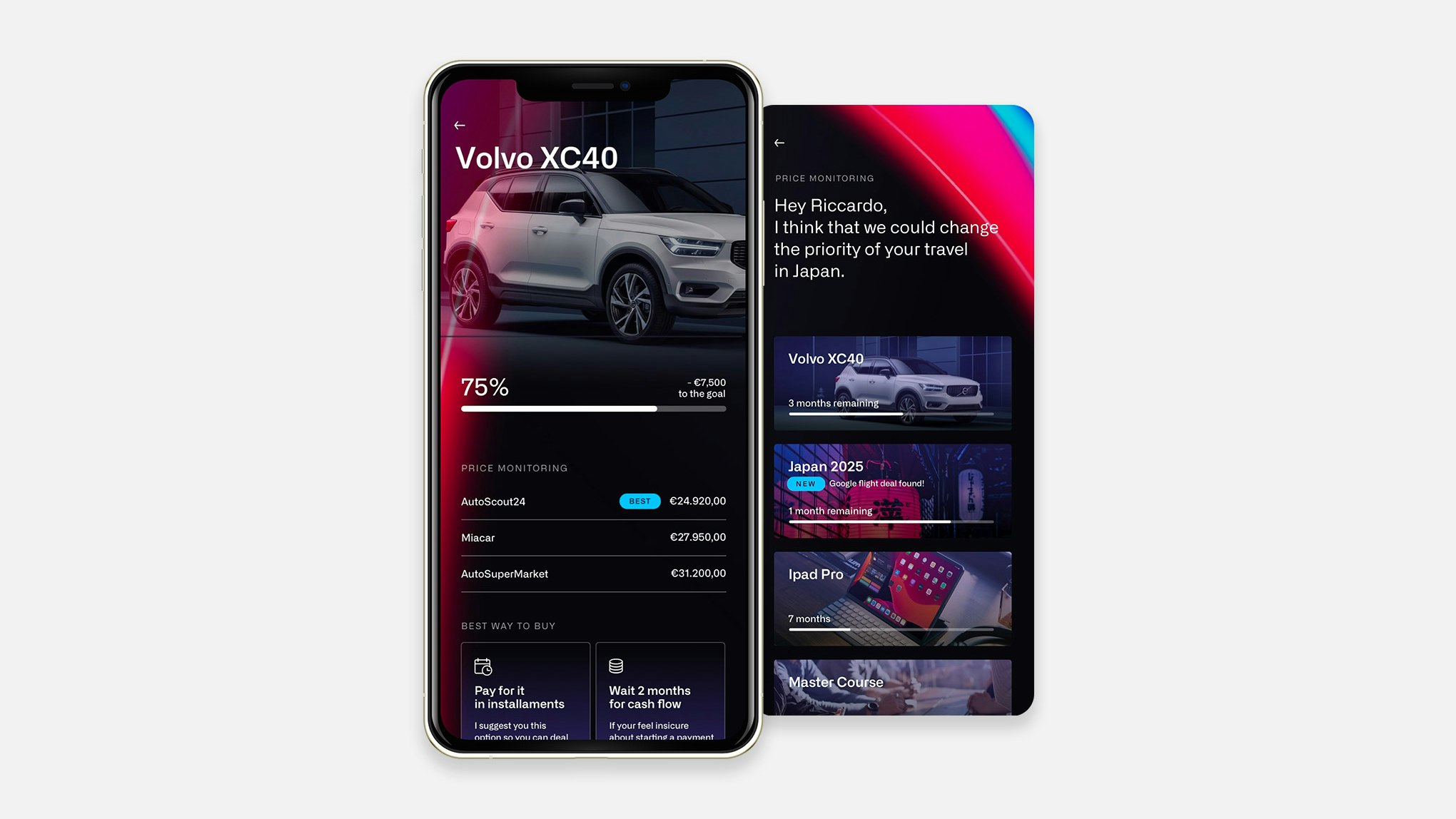

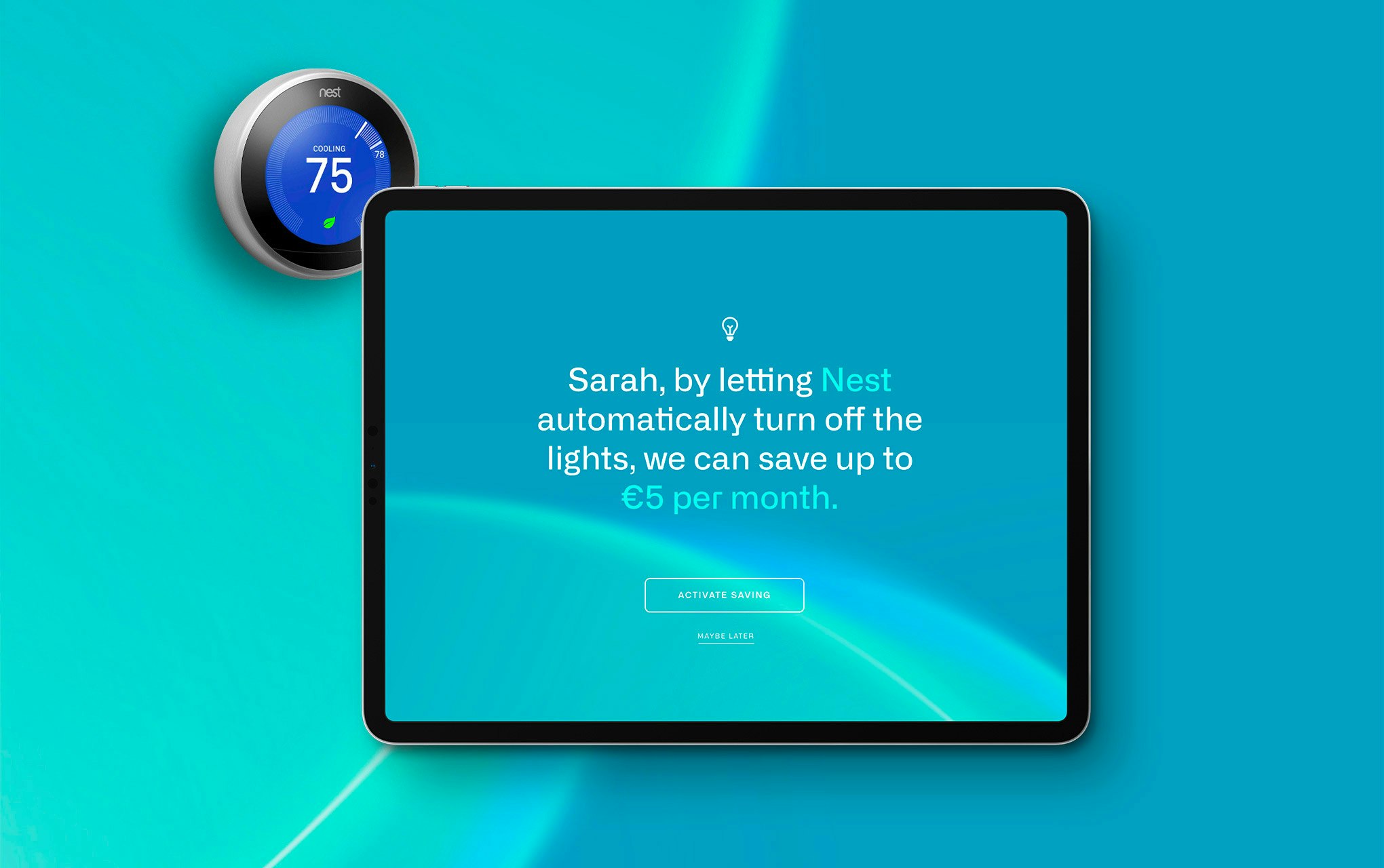

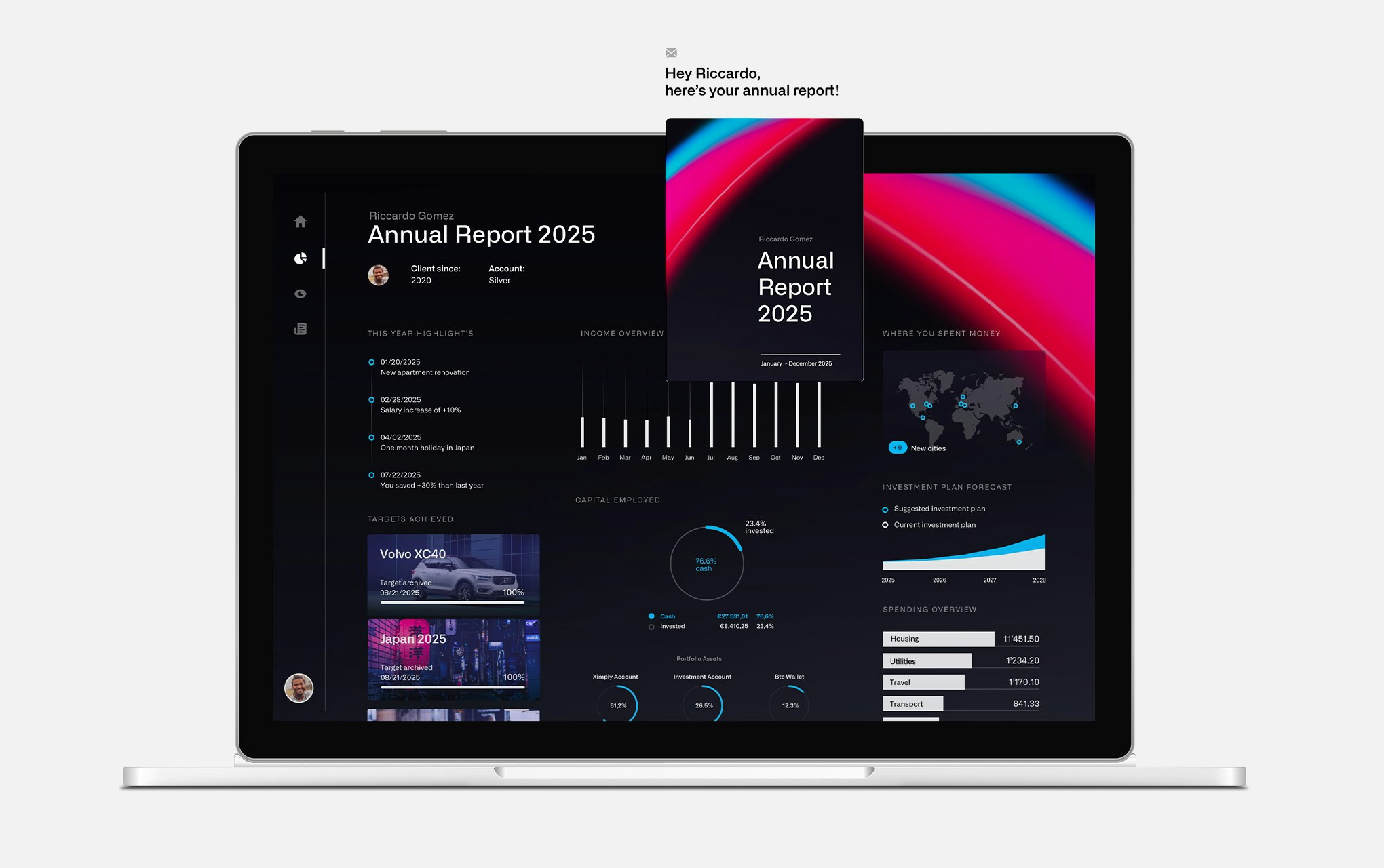

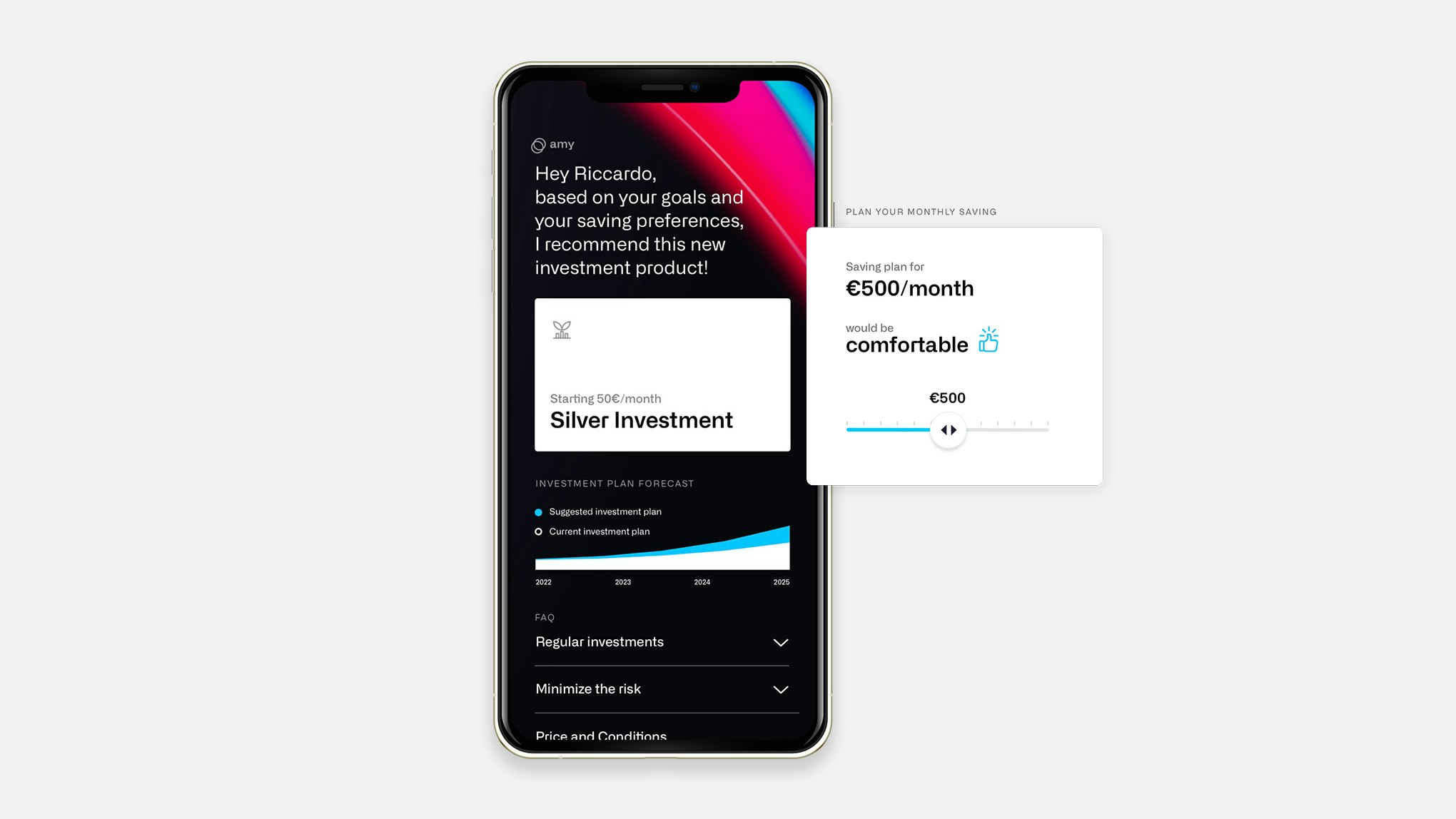

The banking sector needs to change and evolve to face the challenges of the future and, specifically, to create services based on the success of the client and not on the exclusive interests of the banks themselves.

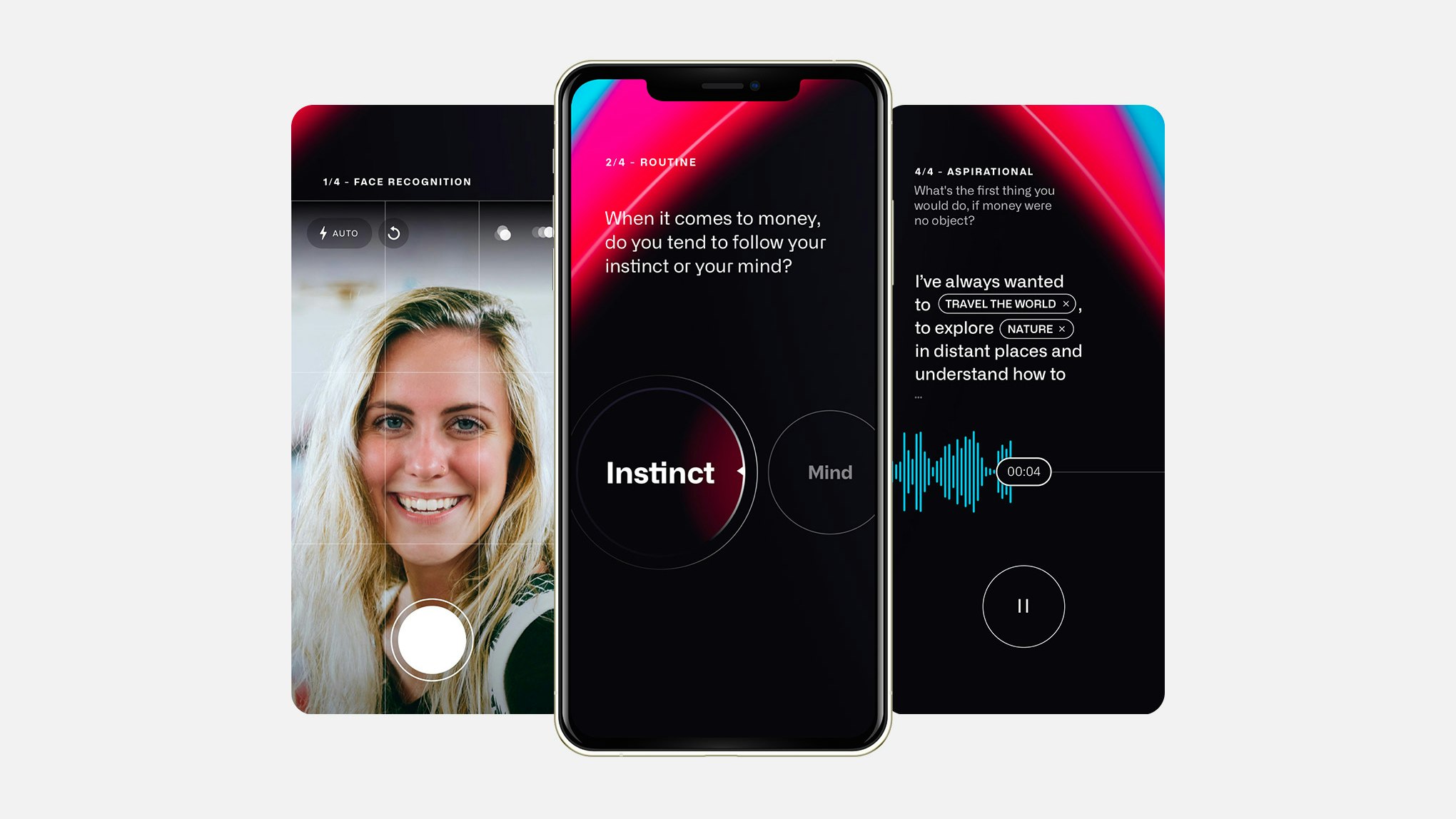

Sketchin's R&D team conducted a strategic foresight activity on the industry based on a few stimulating questions: what form would they take and what would the services of a bank founded on its clients' success be like? How could a relationship between the bank and its customers be sustainable, lasting and mutually satisfying? What kind of future do people's behaviours, the tools and technologies they use show us?